#BFSI Automation

Explore tagged Tumblr posts

Text

Elevating Communication with AI Voice Bot Technology

Imagine a world where businesses can have natural, intelligent conversations with their customers through technology. That’s exactly what an AI voice bot offers. Unlike traditional bots, these advanced systems understand context and respond with meaningful answers, making interactions smoother and more personal.

At VoiceOwl.ai, we’re dedicated to building AI voice bot solutions that fit seamlessly into your existing setup, helping automate customer service and make every interaction count.Our AI voice bots are designed to learn and improve over time, ensuring they keep up with your needs and provide the best possible responses.

Whether you need help with customer support, virtual assistants, or smart home devices, VoiceOwl.ai is here to bring the future of communication to your business.

#Lead verification automation#Lead Qualification automation#BFSI Automation#NBFC Automation#ABM Marketing Automation#Call Center Automation#Conversational AI#RCM Automation#E-commerce Automation#Logistics Automation#Recruitment Automation

0 notes

Text

United States marketing automation market size reached USD 19.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 53.8 Billion by 2033, exhibiting a growth rate (CAGR) of 12.2% during 2025-2033. The rising focus of marketers on strategic initiatives, creative campaigns, and more robust customer relationship management is primarily driving the market growth across the country.

#United States Marketing Automation Market Report by Component Type (Software#Services)#Deployment Type (On-premises#Cloud-based)#End User (SMEs#Large Enterprises)#Application (Campaign Management#Email Marketing#Lead Nurturing and Lead Scoring#Social Media Marketing#Inbound Marketing#and Others)#Vertical (BFSI#Retail#Healthcare#IT and Telecom#Government#Entertainment and Media#Education#and Region 2025-2033

0 notes

Text

Streamline Banking Operations with AI-driven bank Statement Analyzer: Unlocking Efficiency and Detecting Fraud

In today’s fast-paced financial landscape, where efficiency and accuracy are paramount, staying ahead of the competition is crucial for banks and financial institutions. To optimize and analyze credit underwriting processes and automate CAM (credit assessment and monitoring) operations, the adoption of advanced technologies has become imperative. This is where the AI-driven Bank Statement Analyzer comes in. It is a groundbreaking tool that leverages the power of artificial intelligence and machine learning to streamline operations, unlock efficiency, and enhance fraud detection like never before. By analyzing bank statements with speed and accuracy, the AI-Driven Bank Statement Analyzer can quickly identify any irregularities or suspicious activity, allowing financial institutions to take immediate action. This tool not only saves time and resources but also ensures a more secure and reliable credit assessment process for both the institution and its clients.

The role of AI in the Indian financial sector was examined in a study by Ficci and PWC titled “Uncovering the ground truth: AI in Indian financial services” which was released in February 2022. As stated in the report:

The primary drive for AI-enabled use cases, according to 83% of Indian financial services companies or organizations, is improving the client experience.

The majority of them — 57% — strongly concur that AI will provide them an advantage over their competitors.

(Source: Indian FS AI Adoption Survey 2021)

Leading Business Factors for AI-enabled Application Cases

Top Five AI use Cases that Firms have Adopted

Let’s Understand the Bank Statement Analyzer Powered by Artificial Intelligence

The AI-driven Bank Statement Analyzer is an intelligent software solution designed to transform the way financial institutions handle credit underwriting and CAM processes. By harnessing cutting-edge AI algorithms and data analytics, this technology-driven solution simplifies and accelerates the assessment of a borrower’s financial health and risk profile. It can also help identify potential fraud and improve the accuracy of credit decisions. With the AI-driven Bank Statement Analyzer, financial institutions can streamline their operations, reduce costs, and provide better customer service by offering faster loan approvals and more personalized lending options. Additionally, the tool can assist in monitoring a borrower’s repayment behavior and identifying any potential delinquencies or defaults, allowing for proactive measures to be taken to mitigate risk. Overall, the AI-Driven Bank Statement Analyzer is a valuable asset for financial institutions looking to improve their lending processes and make more informed credit decisions.

How Does It Work?

The AI-driven bank Statement Analyzer harnesses the power of artificial intelligence and machine learning to interpret and analyze bank statements with remarkable speed and accuracy. Here’s how it works:

Data Extraction: The system securely extracts relevant financial data from the borrower’s bank statements, eliminating the need for manual data entry and minimizing errors.

Categorization and Trend Analysis: The software automatically categorizes transactions, segregating them into income, expenses, and other relevant categories. It also performs trend analysis to identify spending patterns and financial behaviors.

Financial Health Assessment: Using sophisticated algorithms, the AI-driven Bank Statement Analyzer evaluates the borrower’s financial health by analyzing key indicators such as income stability, cash flow, debt-to-income ratio, and savings patterns.

Fraud Detection: The system incorporates advanced fraud detection techniques to identify suspicious transactions, including money laundering, fraudulent activities, and potential risks.

Account Aggregator Enablement: The AI-driven bank Statement Analyzer seamlessly integrates with account aggregator platforms, allowing financial institutions to securely access and analyze consolidated financial data from the borrower’s multiple bank accounts. This enables a comprehensive assessment of the borrower’s financial position.

Benefits of the AI-Driven Bank Statement Analyzer:

Enhanced Efficiency: The automated analysis of bank statements significantly reduces the time and effort involved in credit underwriting, enabling financial institutions to process loan applications faster and more accurately.

Improved Risk Assessment: The AI-Driven Bank Statement Analyzer provides a holistic view of the borrower’s financial situation, empowering lenders to make better-informed decisions and mitigate risk effectively.

Fraud Detection and Prevention: By leveraging advanced fraud detection techniques, the solution helps financial institutions identify suspicious transactions, enabling timely intervention and preventing fraudulent activities.

Cost Reduction: By automating manual processes and reducing the need for manual data entry, the AI-Driven Bank Statement Analyzer significantly reduces operational costs and increases overall efficiency.

Seamless Integration: The solution seamlessly integrates with existing CAM and credit underwriting platforms, ensuring a smooth implementation process and compatibility with existing systems.

With success comes certain challenges in the Indian financial sector’s use of artificial intelligence

The Indian banking, financial services, and insurance (BFSI) sector is witnessing a growing demand for artificial intelligence (AI) technologies such as chatbots, voice bots, and video bots. However, the sector faces significant challenges in fully embracing AI due to the need for greater clarity in several critical areas, including explainability, fairness, transparency, accountability, probability, and accessibility. Addressing these aspects from both a technological and legal standpoint is crucial for successful AI integration in the sector.

Regulation and Legal Considerations: To regulate AI in India, the Government appointed NITI Aayog in 2018 to develop laws covering ethical and system considerations. However, the current legal infrastructure is still in its early stages and fails to address various implications, including biased data outcomes, sharing of sensitive or personal data, accountability in accidents involving human or property losses, transparency of AI models and outcomes, rights of AI robots, intellectual property rights (IPRs), copyrights, competition laws, and patent credits. The undefined contours of AI applications have resulted in a lag in policymaking and regulation.

Need for Self-Governance and Framework: As the adoption of AI technologies continues at an unprecedented pace worldwide, implementers in the Indian financial sector need to establish a self-governed, self-regulated, and self-audited framework to ensure compliance with laws and regulations. This framework should encompass defining the scope of the problem, unbiased data collection, proper data labeling, data processing, training, deployment, and dynamic evaluation. By adhering to such a framework, organizations can avoid violations and navigate the complexities associated with AI integration.

Choose the Best AI-Driven Bank Statement Analyzer for Your Financial Institution

In the fast-paced world of finance, accurate and efficient analysis of bank statements is crucial for any financial institution. The AI-Driven Bank Statement Analyzer automates the process of extracting valuable insights from these documents, saving time and reducing the risk of errors. However, with a multitude of options available on the market, selecting the right AI-Driven Bank Statement Analyzer can be a daunting task. To help you make an informed decision, we have compiled a guide on how to choose the right AI-Driven Bank Statement Analyzer for your financial institution.

Define Your Requirements: Start by identifying your specific requirements and objectives. Consider the size of your institution, the volume of bank statements you process, and the level of complexity involved. Determine the key features you need, such as data extraction, categorization, trend analysis, or fraud detection. A clear understanding of your requirements will guide you in selecting the most suitable solution.

Evaluate Accuracy and Efficiency: Accuracy and efficiency are paramount when it comes to bank statement analysis. Look for AI-driven bank Statement Analyzers that employ advanced AI algorithms and machine learning techniques to ensure precise data extraction and reliable analysis. Efficiency is equally important, as the timely processing of statements can significantly impact your institution’s operations. Consider solutions that offer high processing speed and can handle large volumes of statements without compromising accuracy.

Integration Capabilities: Compatibility with your existing systems and workflows is crucial for seamless integration. The chosen AI-driven bank Statement Analyzer should be able to integrate with your financial institution’s core banking software, accounting systems, and other relevant platforms. It should allow for easy data transfer, enabling efficient collaboration among different departments and stakeholders.

Customization and Flexibility: Every financial institution has unique requirements and the AI-Driven Bank Statement Analyzer should be flexible enough to accommodate them. Look for a solution that offers customization options, allowing you to tailor the analysis process to your institution’s specific needs. The ability to define custom rules, filters, and reporting formats can significantly enhance the analyzer’s effectiveness.

Security and Compliance: When dealing with sensitive financial data, security and compliance are of utmost importance. Ensure that the AI-driven bank Statement Analyzer you choose adheres to strict security protocols, including encryption, access controls, and data protection measures. It should also comply with relevant industry regulations and standards, such as GDPR or PCI DSS, to safeguard customer information and maintain data integrity.

Scalability and Future-Proofing: Consider the scalability of the AI-Driven Bank Statement Analyzer as your institution grows. Ensure that the solution can handle increased volumes of statements and adapt to evolving business needs. Look for providers that offer regular updates and enhancements to keep pace with industry advancements. Future-proofing your investment will save you from the hassle of switching to a new analyzer soon.

User Experience and Support: Usability and user experience play a significant role in successfully implementing any technology. Choose an AI-Driven Bank Statement Analyzer that is intuitive, user-friendly, and requires minimal training. Look for a provider that offers comprehensive technical support, including documentation, training resources, and responsive customer service. A reliable support system will ensure smooth operations and quick resolution of any issues.

Cost and Return on Investment: Evaluate the total cost of ownership for the AI-Driven Bank Statement Analyzer, including initial setup costs, licensing fees, maintenance expenses, and any additional charges. Compare the costs against the expected return on investment (ROI). Consider factors such as time saved, reduction in errors, improved efficiency, and the ability to uncover valuable insights. A solution with a favorable ROI will prove to be a worthwhile investment for your financial institution.

By following these guidelines and conducting thorough research, you will be able to select an AI-driven bank Statement Analyzer that aligns with your institution’s goals and maximizes operational efficiency. Remember to evaluate multiple vendors and request demonstrations or trials to assess the usability and functionality of different solutions. Additionally, seek feedback from other financial institutions or industry professionals to gather insights and recommendations based on their experiences. Taking a collaborative approach will help you make a well-informed decision and choose the AI-Driven Bank Statement Analyzer that best suits your institution’s needs.

Once you have selected the right AI-Driven Bank Statement Analyzer, it’s essential to plan for a smooth implementation process. Collaborate with the solution provider to create an implementation strategy that aligns with your institution’s existing systems and workflows. Define clear timelines, allocate resources, and communicate the changes to relevant stakeholders within your organization.

During the implementation phase, provide comprehensive training to your staff to ensure they are proficient in using the AI-Driven Bank Statement Analyzer. The solution provider should offer training materials, user manuals, and ongoing support to address any questions or concerns that may arise.

Post-implementation, continuously monitor the performance of the AI-Driven Bank Statement Analyzer and gather feedback from users. Regularly assess its effectiveness, identify areas for improvement, and collaborate with the solution provider to implement necessary updates or enhancements.

The Novel Patterns– CART — AI-Driven Bank Statement Analyzer’s ability to assist financial institutions in identifying fraud and saving sizeable sums of money is one of its key advantages. With a track record to back it up, CART has already won over 100 major clients’ trust and processes more than 250 million transactions each month. CART has successfully detected fraudulent activity and owing to its efficient fraud detection technique, averting potential losses of over INR 100 million every month. These astounding figures demonstrate how the Novel Patterns — CART — AI-Driven Bank Statement Analyzer protects financial institutions and strengthens their dedication to offering their clients safe and dependable services. Financial institutions can benefit from the most recent technology by utilizing AI and sophisticated analytics.

Robust Fraud Detection: CART employs advanced algorithms and machine learning techniques to identify fraudulent activities within bank statements. Its sophisticated fraud detection capabilities enable financial institutions to detect suspicious transactions, money laundering attempts and potential risks effectively. By proactively identifying and preventing fraudulent activities, CART helps safeguard the financial integrity of institutions and protects them from significant financial losses.

Impressive Client Base: With its proven track record, CART has gained the trust of more than 75 major clients in the financial industry. This extensive client base reflects the reliability and effectiveness of the solution. Financial institutions can benefit from CART’s established reputation and industry-wide adoption, ensuring they are utilizing a trusted and reputable tool for their bank statement analysis needs.

High Transaction Volume: CART is equipped to handle high transaction volumes efficiently. It processes over 250 million transactions on a monthly basis, showcasing its scalability and ability to manage large-scale operations. Financial institutions dealing with substantial transaction volumes can rely on CART to effectively analyze and extract valuable insights from their bank statements, regardless of the volume.

Substantial Cost Savings: By leveraging CART’s robust fraud detection techniques, financial institutions have achieved significant cost savings. The solution has helped prevent potential losses of over INR 100 million by identifying fraudulent activities early on. Detecting and mitigating fraudulent transactions not only saves financial institutions from financial losses but also protects their reputation and customer trust. CART’s ability to detect fraud efficiently contributes to the overall cost reduction and financial stability of institutions.

Cutting-edge Technology: The Novel Patterns — CART — AI-Driven Bank Statement Analyzer incorporates advanced technologies such as artificial intelligence and machine learning. These technologies enable CART to continuously learn and adapt to evolving patterns and trends in bank statements. By leveraging cutting-edge technology, financial institutions can stay ahead of emerging fraud schemes, improve their risk management capabilities, and make more informed decisions.

Enhanced Operational Efficiency: CART streamlines bank statement analysis processes, resulting in improved operational efficiency for financial institutions. By automating manual tasks such as data extraction and categorization, CART reduces the time and effort required to analyze bank statements. This automation allows institutions to process loan applications faster, make quicker lending decisions, and provide better customer service. The increased efficiency and streamlined processes contribute to overall operational excellence and improved customer satisfaction.

In conclusion, the AI-driven Bank Statement Analyzer is a transformative solution for financial institutions, revolutionizing operations by offering improved efficiency, enhanced risk assessment, fraud detection capabilities, and significant cost reduction. By carefully selecting and implementing this technology, institutions can unlock their full potential, staying ahead in the competitive financial landscape. Embracing the power of AI, financial institutions can elevate their bank statement analysis to new heights. The Novel Patterns — CART — AI-Driven Bank Statement Analyzer serves as a powerful tool, enabling institutions to detect fraud effectively and achieve substantial cost savings. With its robust capabilities, impressive client base, ability to handle high transaction volumes, cutting-edge technology, and enhanced operational efficiency, CART empowers financial institutions to strengthen risk management practices, protect financial integrity, and deliver superior services to customers. By adopting CART, institutions can leverage advanced analytics and AI-driven solutions, gaining a competitive edge in today’s dynamic financial landscape

#cart#fintech#novel patterns#account aggregator#bfsi#wealth management#credit underwriting#finance#banking#automation#bank statements#bank statemen analyzer

0 notes

Text

Driving Innovation: A Case Study on DevOps Implementation in BFSI Domain

Banking, Financial Services, and Insurance (BFSI), technology plays a pivotal role in driving innovation, efficiency, and customer satisfaction. However, for one BFSI company, the journey toward digital excellence was fraught with challenges in its software development and maintenance processes. With a diverse portfolio of applications and a significant portion outsourced to external vendors, the company grappled with inefficiencies that threatened its operational agility and competitiveness. Identified within this portfolio were 15 core applications deemed critical to the company’s operations, highlighting the urgency for transformative action.

Aspirations for the Future:

Looking ahead, the company envisioned a future state characterized by the establishment of a matured DevSecOps environment. This encompassed several key objectives:

Near-zero Touch Pipeline: Automating product development processes for infrastructure provisioning, application builds, deployments, and configuration changes.

Matured Source-code Management: Implementing robust source-code management processes, complete with review gates, to uphold quality standards.

Defined and Repeatable Release Process: Instituting a standardized release process fortified with quality and security gates to minimize deployment failures and bug leakage.

Modernization: Embracing the latest technological advancements to drive innovation and efficiency.

Common Processes Among Vendors: Establishing standardized processes to enhance understanding and control over the software development lifecycle (SDLC) across different vendors.

Challenges Along the Way:

The path to realizing this vision was beset with challenges, including:

Lack of Source Code Management

Absence of Documentation

Lack of Common Processes

Missing CI/CD and Automated Testing

No Branching and Merging Strategy

Inconsistent Sprint Execution

These challenges collectively hindered the company’s ability to achieve optimal software development, maintenance, and deployment processes. They underscored the critical need for foundational practices such as source code management, documentation, and standardized processes to be addressed comprehensively.

Proposed Solutions:

To overcome these obstacles and pave the way for transformation, the company proposed a phased implementation approach:

Stage 1: Implement Basic DevOps: Commencing with the implementation of fundamental DevOps practices, including source code management and CI/CD processes, for a select group of applications.

Stage 2: Modernization: Progressing towards a more advanced stage involving microservices architecture, test automation, security enhancements, and comprehensive monitoring.

To Expand Your Awareness: https://devopsenabler.com/contact-us

Injecting Security into the SDLC:

Recognizing the paramount importance of security, dedicated measures were introduced to fortify the software development lifecycle. These encompassed:

Security by Design

Secure Coding Practices

Static and Dynamic Application Security Testing (SAST/DAST)

Software Component Analysis

Security Operations

Realizing the Outcomes:

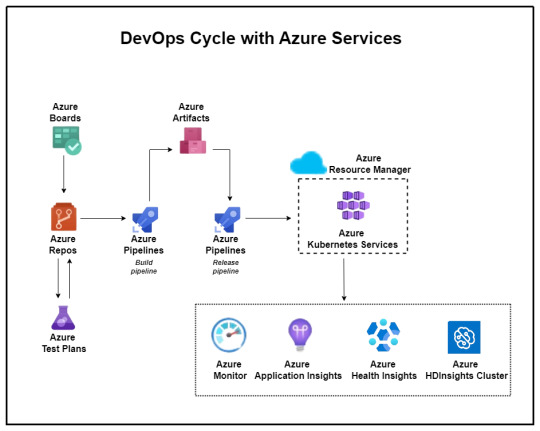

The proposed solution yielded promising outcomes aligned closely with the company’s future aspirations. Leveraging Microsoft Azure’s DevOps capabilities, the company witnessed:

Establishment of common processes and enhanced visibility across different vendors.

Implementation of Azure DevOps for organized version control, sprint planning, and streamlined workflows.

Automation of builds, deployments, and infrastructure provisioning through Azure Pipelines and Automation.

Improved code quality, security, and release management processes.

Transition to microservices architecture and comprehensive monitoring using Azure services.

The BFSI company embarked on a transformative journey towards establishing a matured DevSecOps environment. This journey, marked by challenges and triumphs, underscores the critical importance of innovation and adaptability in today’s rapidly evolving technological landscape. As the company continues to evolve and innovate, the adoption of DevSecOps principles will serve as a cornerstone in driving efficiency, security, and ultimately, the delivery of superior customer experiences in the dynamic realm of BFSI.

Contact Information:

Phone: 080-28473200 / +91 8880 38 18 58

Email: [email protected]

Address: DevOps Enabler & Co, 2nd Floor, F86 Building, ITI Limited, Doorvaninagar, Bangalore 560016.

#BFSI#DevSecOps#software development#maintenance#technology stack#source code management#CI/CD#automated testing#DevOps#microservices#security#Azure DevOps#infrastructure as code#ARM templates#code quality#release management#Kubernetes#testing automation#monitoring#security incident response#project management#agile methodology#software engineering

0 notes

Text

Why Documentation in BFSI sector is not a challenge anymore?

Apart from government agencies, employees working in banks & other financial institutions have to adhere to the enormous amount of rules & regulations when it comes to managing information.

Information also includes the confidential data that is maintained on the bank’s servers, as well as documents that are submitted by customers & businesses that have some kind of working relationship with the bank.

Document ‘Identification’ & ‘Maintenance’ – A growing challenge for Banks & other Financial Institutions

As per a report, Identity of Client (bank accounts opened with names similar to other established business entities, false identification documents, etc.) is one of the most important factors that can make or break the reputation of a bank. Employees have to deal with a significant amount of paperwork, though financial institutions are trying their best in order to keep the costs of maintaining these paper documents under control. Take the case of maintaining the documents submitted by a new customer at the time of opening a new bank account. There is a significant amount of data from the account opening form that needs to be fed to the back-end system and any error caused by the manual entry can result in loss of business, indirectly impacting the ‘client satisfaction index’. As banks have to adhere to a lot of regulatory and compliance standards, maintaining documentation for compliance is also a big task. Irrespective of the nature of the documents e.g. account opening forms, loan processing forms, KYC (Know Your Customer), mortgage forms, etc.; they need to be maintained in a manner where less effort is spent on ‘Document Identification’. If the bank falters in any of these tasks, it would hamper the productivity of the staff.

Document ‘Standards’ & ‘Retrieval’: Unstructured & non-uniform formats followed by different departments impacting ‘customer experience’

Irrespective of the size of the bank, the overall structure of any banking organization is considered to be highly complex as there are a number of departments providing different services to their esteemed customers. Hence, each department might be having its own format of document descriptions, document folder structure, metadata, etc. which makes the task of accessing/editing/searching ‘common’ documents across departments a tedious task. Inadequate content management can make retrieval of important documents highly complex, thereby impacting the pace at which the other follow-on activities are executed. These delays can result in a sub-optimal customer experience which can negatively impact the bank’s brand & business. The tasks like document processing, extracting customer information from the form, matching customer signature to prevent frauds, etc. are mundane in nature, yet very critical in nature; so they need to be performed with utmost precision. However, due to the mundane nature of these tasks, they are more prone to manual errors. Though the problems mentioned so far are different in nature, there is a common pattern in each of them – bank representatives have to review a number of documents and in most scenarios, he/she has to manually enter the details at the back-end. How can banks get out of this ‘document chaos’ and keep their employees motivated to provide excellent services to their customers?

Intelligent information Management (IIM) – Solving the ‘documentation crisis’ faced by the BFSI sector

Intelligent information Management (IIM) platform from AIQoD can be instrumental in automating critical activities mentioned below

Capture – Gather input from tools like scanners, ERP, spreadsheets, etc.

Processing – Match, structure, and figure out ‘any’ discrepancy in the data

Routing – Insertion of data in the ERP or any other backend/accounting system

Retrieval – Retrieve or query data from ERP or any other backend/accounting system

The platform leverages technologies like Machine Learning (ML), Artificial Intelligence (AI), Image Processing, etc. in order to bring intelligence to a routine, yet critical job like ‘Documentation’. Highly accurate Handwriting Recognition feature in the platform can be used for signature verification. Optical Character Recognition (OCR) feature in cognizance with mobile capture & recognition feature identifies and extracts text from documents and images, thereby eliminating chances of error in processing and management. Irrespective of the department, employees within the bank can use a common automated workflow for input, indexing, search, and processing of documents so that they can focus on activities that require creative intelligence, rather than spending their time in scouting for documents. Incorporation of IIM in a task like ‘documentation’ can have far-fetched benefits, some of which are listed below

Centralized Access to documents

Faster retrieval & processing of documents

Compliance with the required financial regulations

Enhanced accuracy of documents

Boost in employee’s morale and productivity

Conclusion

RPA for ‘documentation identification & maintenance’ for BFSI sector has multi-fold benefits and can help in providing enhanced customer experience, engaging employees with important tasks and saving overhead costs.

0 notes

Text

Harnessing Automation: RPA in Banking Industry

Robotic Process Automation (RPA) assists banks and accounting units in automating repetitive manual operations, allowing staff to concentrate on more important activities and giving the company a competitive edge. Let’s discuss more about prominent use cases and benefits of RPA in Banking and Finance.

Harness the power of automation in the banking industry. Explore the multifaceted benefits and applications of RPA for a competitive edge in finance.

#RPA in banking and finance#RPA in banking industry#RPA in banking#RPA in banking sector#RPA automation in banking#benefits of RPA in banking#RPA applications in banking#RPA use cases in banking#RPA in banking and financial sector#RPA in bfsi sector#use of RPA in banking#RPA in bfsi

0 notes

Text

Robotic Process Automation in BFSI Market Key Players, Industry Overview, Application and Analysis to 2024 to 2031

Robotic Process Automation in BFSI Market: Navigating the Future of Financial Operations

The Robotic Process Automation in BFSI Market was valued at 710.63 Billion in 2022 and expected to grow at CAGR of 40.1% over forecast period. In the dynamic landscape of the Banking, Financial Services, and Insurance (BFSI) sector, the integration of Robotic Process Automation (RPA) has emerged as a transformative force, reshaping traditional workflows and operational paradigms. RPA, a technology that utilizes robots or 'bots' to automate repetitive tasks, is gaining widespread adoption in the BFSI sector due to its potential to enhance efficiency, reduce operational costs, and mitigate risks.

Get the PDF Sample Copy (Including FULL TOC, Graphs, and Tables) of this report @ https://www.sanglobalresearch.com/request-sample/3039

Overview:

The BFSI sector, being data-intensive and compliance-driven, has recognized the significance of RPA in optimizing processes. RPA in BFSI involves the deployment of software robots to perform rule-based tasks, such as data extraction, validation, and reconciliation, across various functions like customer onboarding, account management, fraud detection, and regulatory compliance. This automation not only accelerates routine tasks but also ensures accuracy, enabling financial institutions to redirect human resources to more strategic and value-added activities.

Drivers:

Several factors fuel the rapid adoption of RPA in the BFSI sector. One of the primary drivers is the quest for operational efficiency. RPA streamlines mundane tasks, allowing financial institutions to handle vast volumes of data swiftly and accurately. Cost reduction is another compelling driver as RPA diminishes the need for manual intervention, leading to significant savings in labor costs. Additionally, regulatory compliance is a critical aspect of the BFSI sector, and RPA ensures adherence to stringent norms by minimizing errors and ensuring consistency in processes.

Restraints:

Despite the promising prospects, the integration of RPA in BFSI is not without challenges. One notable constraint is the initial investment required for implementation. While the long-term benefits are substantial, some financial institutions may hesitate due to the upfront costs associated with acquiring and implementing RPA solutions. Moreover, concerns regarding data security and privacy may act as a deterrent, especially in an industry where safeguarding sensitive customer information is paramount.

Growth Factors:

The growth of RPA in BFSI is propelled by its adaptability to diverse processes within the sector. As financial institutions increasingly recognize the potential of RPA to enhance customer experience, the technology is witnessing widespread adoption. Moreover, the scalability of RPA solutions ensures that they can be tailored to fit the unique requirements of different organizations, irrespective of their size or complexity. The continuous advancements in RPA technology, including the incorporation of artificial intelligence and machine learning capabilities, further contribute to its sustained growth in BFSI.

Future Outlook:

The future of RPA in BFSI appears promising, with ongoing technological advancements and a growing emphasis on digital transformation. The integration of cognitive capabilities, such as natural language processing and sentiment analysis, will elevate RPA from rule-based automation to a more intelligent and adaptive solution. This evolution is expected to drive innovation in areas like customer service, risk management, and decision-making processes, positioning RPA as a cornerstone of BFSI's digital evolution.

In conclusion, the integration of Robotic Process Automation in the BFSI sector represents a transformative shift in operational dynamics. As financial institutions navigate the challenges of a rapidly evolving landscape, RPA stands out as a key enabler of efficiency, cost-effectiveness, and compliance. While hurdles exist, the numerous drivers and growth factors underscore the inevitability of RPA becoming an integral part of the future of BFSI operations.

Get Customization on this Report: https://www.sanglobalresearch.com/customization/3039

Key Companies Profiled: NICE; Nintex UK Ltd. (Kryon Systems); Pegasystems Inc.; Protiviti Inc.; UiPath; WorkFusion, Inc., Antworks, Atos SE; Automation Anywhere, Inc.; Blue Prism Limited; EdgeVerve Systems Ltd.; FPT Software; IBM; Kofax Inc.; Microsoft (Softomotive)

Global Robotic Process Automation in BFSI Market, Report Segmentation

Robotic Process Automation in BFSI Market, By Type

Software

Services

Services

Robotic Process Automation in BFSI Market, By Organization

SMEs

Large Enterprises

Robotic Process Automation in BFSI Market, By Application

Banking

Financial Services & Insurance

Global Anti-aging Devices Market, Regional Outlook

North America (U.S., Canada, and Mexico)

Europe (Germany, France, Italy, Spain, U.K., Russia, and Rest of Europe)

Asia Pacific (China, India, Japan, Australia, and Rest of Asia Pacific)

South America (Brazil, Argentina, and Rest of South America)

Middle East & Africa (South Africa, UAE, and Rest of ME&A)

To know about the assumptions considered for the study download the pdf brochure: https://www.sanglobalresearch.com/report/robotic-process-automation-in-bfsi-market/3039

Thank you for reading the report. The report can be customized as per the requirements of the clients. For further information or query about customization, please reach out to us, and we will offer you the report best suited for your needs.

Related Reports:

Artificial Intelligence Market: https://sanglobalresearch.com/report/artificial-intelligence-market/3027

Artificial Intelligence in Construction Market: https://sanglobalresearch.com/report/artificial-intelligence-in-construction-market/3026

About Us:

At San Global Research Report, we pride ourselves on our commitment to quality and accuracy. Our team of experienced researchers utilizes a combination of quantitative and qualitative methods to ensure that our findings are both accurate and reliable. With a strong emphasis on responsiveness, transparency, and collaboration, we work closely with our clients to understand their objectives and deliver actionable insights. Learn more about our research approach and how it can benefit your business.

Contact Us:

Address: Gera Imperium Rise, Phase 2 Hinjewadi, Pune, India

San Global Research | Web: http://www.sanglobalresearch.com

Direct Line: +91 9209275355

E-mail: [email protected]

0 notes

Text

Making Middle East BFSI Future Ready Today!

Elevating CX with AI-Led Hyper-personalization - for a Modern age "Digital BFSI" of Middle East

0 notes

Text

#Ai-powered#Ai automation#chatbot#ai chatbot#fintech#BFSI#business#artificial intelligence#bots#customer service#werqlabs

0 notes

Text

Reimagining How We Talk to Technology: Voice Assistant Bots and Generative AI

Keeping up with all the communication tasks in a busy business can be tough. That’s where our Voice Assistant Bots at VoiceOwl.ai can help. We’ve designed these bots to take the load off your team by automating key processes, so they can focus on what really matters—growing your business and boosting sales.

Imagine your sales reps spending their time only on leads that are ready to convert, while our Voice Assistant Bots handle the rest. They can verify, qualify, and nurture leads, making sure your team is always talking to the right people at the right time. This doesn’t just save time—it helps you have 10 times more meaningful conversations, which can seriously boost your sales.

And it doesn’t stop there. Our Voice Assistant Bots can also scale up your sales, pre-sales, and even debt collection calls. By automating these tasks, you reduce the manual work, cut costs by up to 60%, and let your team focus on the bigger picture—like building strong customer relationships and closing more deals.

With VoiceOwl.ai, you’re not just getting a tool—you’re getting a smarter way to communicate. Let our Voice Assistant Bots handle the repetitive stuff, so your team can do what they do best: grow your business.

#Lead verification automation#Lead Qualification automation#BFSI Automation#NBFC Automation#ABM Marketing Automation#Call Center Automation#Conversational AI#RCM Automation#E-commerce Automation#Logistics Automation#Recruitment Automation

0 notes

Text

#United States Marketing Automation Market Report by Component Type (Software#Services)#Deployment Type (On-premises#Cloud-based)#End User (SMEs#Large Enterprises)#Application (Campaign Management#Email Marketing#Lead Nurturing and Lead Scoring#Social Media Marketing#Inbound Marketing#and Others)#Vertical (BFSI#Retail#Healthcare#IT and Telecom#Government#Entertainment and Media#Education#and Region 2024-2032

0 notes

Text

Superior BFSI Software Testing Solutions for Your Financial Success in 2025

Introduction to BFSI Software Testing

BFSI Software Testing shapes the backbone of digital banking and financial solutions. Precision, efficiency, and security are essential for your business to gain a competitive advantage. The industry faces constant regulatory changes, rapid digitalization, and complex user expectations. BFSI (Banking, Financial Services, and Insurance) organizations cannot afford errors in their applications. Reliable BFSI Software Testing by ideyaLabs ensures systems work as intended, safeguard sensitive information, and deliver seamless user experiences.

The Imperative of Rigorous Testing in BFSI

Financial institutions store and manage sensitive customer data. Even a minor flaw can result in financial losses or regulatory penalties. ideyaLabs delivers comprehensive BFSI Software Testing to protect your business and reputation. Testing solutions detect vulnerabilities, performance bottlenecks, and security loopholes. This proactive approach guarantees uninterrupted banking and insurance operations. Customers trust your services knowing their transactions remain secure.

Comprehensive BFSI Application Coverage

BFSI environments depend on a large ecosystem of software. Core banking, digital wallets, insurance management, loan origination, trading platforms, and payment gateways form critical components. ideyaLabs tests each module to meet the highest industry standards. Seamless integration interoperability between systems ensure a consistent user experience. Our validation processes include functional, security, performance, compliance, and usability perspectives.

Industry-Leading Functional Testing

Functionality drives the success of BFSI applications. ideyaLabs validates all user journeys, from account creation to transaction completion and report generation. System functions produce accurate and expected results. We execute detailed test cases, identify defects at early stages, and accelerate your go-to-market speed. Our BFSI Software Testing covers both front-end interfaces and back-end processes for reliable operations.

Robust Security Testing for Data Protection

Security stands as a top priority in BFSI Software Testing. ideyaLabs protects applications from cyber threats including data breaches, identity theft, and fraudulent activities. Our experts conduct vulnerability assessments and penetration testing. We identify weak spots and security misconfigurations early in the SDLC. Encryption, authentication, and authorization controls remain thoroughly checked. This ensures only authorized users access sensitive information.

Performance Testing for Uninterrupted Services

BFSI applications must handle large volumes of transactions, especially during peak times. ideyaLabs introduces rigorous performance and load testing methodologies. Systems sustain high throughput without latency or failures under stress. Bottlenecks, memory leaks, and resource constraints get detected before production rollout. Optimizing application scalability becomes possible through our systematic approach.

Compliance Testing to Meet Regulatory Requirements

Regulations change frequently. Your business cannot fall behind in adapting to new mandates. ideyaLabs remains updated with the latest financial standards and compliance norms. BFSI Software Testing verifies alignment with global and regional industry regulations. Our team helps you achieve consistent regulatory compliance and avoid penalties. Automated test suites ensure you stay ahead of audits and inspections.

End-to-End Digital Experience Assurance

Customer experience in BFSI now happens predominantly on digital channels. ideyaLabs tests interfaces for usability, accessibility, and responsiveness. Omnichannel user flows across web, mobile, and wearable apps remain smooth and reliable. Our goal is to enhance your brand reputation by delivering intuitive, bug-free user experiences. We reduce digital drop-off rates and drive higher customer satisfaction for your business.

Agile Testing Strategies for Fast-Paced BFSI Markets

Banking and finance companies innovate continuously. ideyaLabs incorporates Agile and DevOps principles in BFSI Software Testing. Testing activities seamlessly integrate into your continuous integration and deployment pipelines. Early feedback, dynamic test planning, and rapid releases become a reality. You accelerate product launches and stay ahead of market trends without sacrificing quality.

Automated Testing for Faster Time-to-Market

Speed matters in financial technology. ideyaLabs automates repetitive and critical test scenarios for BFSI applications. Automated test scripts run daily cycles to identify regressions quickly. You minimize manual efforts and cut down time to market. Our frameworks scale effortlessly as your application portfolio expands. Consistent quality remains standard, even with frequent updates and new features.

API and Integration Testing for End-to-End Assurance

Open banking, third-party integrations, and microservices define modern BFSI ecosystems. ideyaLabs focuses on API testing as a core service. Our experts validate data flows, authentication protocols, and business logic via automated scripts. You experience seamless system interactions, zero data loss, and uninterrupted workflows across platforms.

Mobile Application Testing for BFSI On-the-Go

Customers access BFSI services primarily through mobile devices. ideyaLabs tests across Android and iOS devices for performance, usability, and security. Applications adapt smoothly across device models, screen sizes, and network conditions. Our approach covers both native and hybrid mobile apps. Customers stay connected to your services from anywhere at any time.

Data Migration and Validation Testing

Migrations and upgrades occur regularly within BFSI infrastructures. ideyaLabs validates data transfer processes between legacy systems and modern platforms. We ensure data integrity, accuracy, and completeness. No transaction gets lost during migration. System transitions remain reliable and risk-free.

Custom Reporting and Analytics Validation

BFSI decisions depend on data analytics and reporting tools. ideyaLabs evaluates the accuracy and performance of dashboards and report generators. We verify data sources, business logic, and output formats. Decision-makers receive reliable insights that support growth and compliance. Our BFSI Software Testing keeps your analytics robust and trustworthy.

Continuous Improvement With Real-Time Monitoring

Problem resolution does not end after deployment. ideyaLabs offers post-release monitoring and support. We integrate real-time analytics and alerting tools into your workflows. Application health checks detect issues quickly. Continuous improvement elevates the resilience and reliability of your systems.

Domain Expertise and Industry Experience

BFSI software solutions need a specialized approach. ideyaLabs employs domain experts with years of experience in financial and insurance systems. Our professionals understand workflows, compliance requirements, and customer expectations. Industry best practices and proven methodologies shape every BFSI Software Testing project.

Proven Track Record in BFSI Software Testing

ideyaLabs has delivered success stories to global banking and insurance customers. Our end-to-end services cover digital banks, fintech startups, traditional lenders, insurance aggregators, and more. We adapt to the unique needs of each client. Our testing accelerates digital transformation and enhances business agility.

The Future of BFSI Demands Reliable Testing

BFSI institutions tackle fierce competition, emerging technologies, and evolving risks in 2025. ideyaLabs enables you to address these challenges with reliable and scalable BFSI Software Testing. Integrating AI-driven test automation, cybersecurity best practices, and continuous delivery models keeps your operations one step ahead.

Partner With ideyaLabs for BFSI Software Testing Excellence

The success of your financial products depends on systematic and thorough testing practices. ideyaLabs empowers your business to deliver secure, compliant, and user-friendly applications. Partner with us to enhance customer trust, meet regulations, optimize performance, and innovate rapidly.

Conclusion: Secure Your Position in 2025 with Trusted BFSI Software Testing

BFSI Software Testing by ideyaLabs provides the foundation for success, trust, and sustainable growth. Invest in comprehensive validation, security evaluation, and performance optimization. Reach out to ideyaLabs today and embrace a future where your financial solutions lead the market with confidence and reliability.

0 notes

Text

Automation testing market

Automation testing market size is forecast to reach $72501 million by 2030, growing at CAGR 14.50% during 2024–2030.

🔗 𝐆𝐞𝐭 𝐑𝐎𝐈-𝐟𝐨𝐜𝐮𝐬𝐞𝐝 𝐢𝐧𝐬𝐢𝐠𝐡𝐭𝐬 𝐟𝐨𝐫 𝟐𝟎𝟐𝟓-𝟐𝟎𝟑𝟏 → 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐍𝐨𝐰

Automation Testing Market is experiencing rapid growth, driven by the increasing demand for faster software development cycles, improved quality assurance, and the adoption of DevOps and Agile methodologies. Automation testing uses tools and scripts to execute tests automatically, reducing manual effort, minimizing human error, and accelerating time-to-market. Key technologies like AI, machine learning, and continuous integration are enhancing test coverage and efficiency. Sectors such as IT, BFSI, healthcare, and retail are major adopters.

🚀 𝐊𝐞𝐲 𝐌𝐚𝐫𝐤𝐞𝐭 𝐃𝐫𝐢𝐯𝐞𝐫𝐬:

𝐀𝐝𝐨𝐩𝐭𝐢𝐨𝐧 𝐨𝐟 𝐃𝐞𝐯𝐎𝐩𝐬 & 𝐀𝐠𝐢𝐥𝐞 𝐌𝐞𝐭𝐡𝐨𝐝𝐨𝐥𝐨𝐠𝐢𝐞𝐬

��� Continuous integration and delivery require fast, reliable, and repeatable testing processes.

𝐆𝐫𝐨𝐰𝐢𝐧𝐠 𝐃𝐞𝐦𝐚𝐧𝐝 𝐟𝐨𝐫 𝐅𝐚𝐬𝐭𝐞𝐫 𝐓𝐢𝐦𝐞-𝐭𝐨-𝐌𝐚𝐫𝐤𝐞𝐭

– Automation reduces test cycle duration, enabling quicker software releases.

𝐑𝐢𝐬𝐢𝐧𝐠 𝐂𝐨𝐦𝐩𝐥𝐞𝐱𝐢𝐭𝐲 𝐨𝐟 𝐒𝐨𝐟𝐭𝐰𝐚𝐫𝐞 & 𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬

– Modern applications require testing across platforms, devices, and environments — automation ensures consistency and scalability.

𝐂𝐨𝐬𝐭 𝐄𝐟𝐟𝐢𝐜𝐢𝐞𝐧𝐜𝐲 & 𝐑𝐎𝐈

– Although initial setup is high, automation reduces long-term testing costs and resource dependency.

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐓𝐫𝐚𝐧𝐬𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐜𝐫𝐨𝐬𝐬 𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐢𝐞𝐬

– Enterprises are automating QA processes to support large-scale digital initiatives and customer-facing applications.

𝐓𝐨𝐩 𝐊𝐞𝐲 𝐏𝐥𝐚𝐲𝐞𝐫𝐬:

Amazon | Alibaba Group | Accenture | IGE/Affinity Media (acq. Tencent Holdings Ltd.) | Cognizant | IBM | Huawei | América Móvil | Cisco | SoftBank Group Corp. | JD.COM | DXC Technology

#AITesting #MLInTesting #SmartTesting #NextGenTesting #DigitalQuality #QAasAService #TechTrends #DigitalTransformation #SoftwareQuality #TechInnovation

0 notes

Text

In the ever-evolving world of finance, speed and accuracy are paramount. With vast volumes of data generated daily, financial professionals are under pressure to not only process information rapidly but also derive meaningful insights for strategic decisions. Enter Generative AI—the next frontier in finance.

From real-time reporting to automated forecasting narratives, generative AI is fundamentally transforming how organizations approach financial analysis. To stay competitive, professionals must embrace this shift—and enrolling in Certification Courses for Financial Analytics in Pune is a powerful first step toward mastering this transformative technology.

What is Generative AI and Why It Matters in Finance?

Generative AI refers to algorithms that can create new content—text, code, reports, or even images—based on patterns in existing data. In finance, this means AI systems can now:

Write financial reports

Summarize quarterly performance

Generate investment insights

Build scenario-based models

Draft executive dashboards in natural language

Unlike traditional analytics tools that merely crunch numbers, generative AI offers a human-like layer of interpretation and communication—bridging the gap between data and decision-makers.

Key Applications of Generative AI in Finance

✅ Automated Financial Reporting

Instead of spending hours drafting monthly or quarterly reports, finance teams can now use AI to auto-generate clear, concise, and regulation-compliant narratives—based on live datasets.

✅ Real-Time Insights for Executives

Generative AI tools like ChatGPT or Microsoft Copilot can pull financial data from spreadsheets or dashboards and generate insights instantly in plain English, making strategic decisions faster and more informed.

✅ Scenario Planning & Risk Analysis

By combining historical data with AI-generated narratives, analysts can simulate multiple future scenarios and create risk reports that highlight potential financial outcomes and recommend actions.

✅ Internal Audit & Compliance Reporting

AI models can scan transaction histories, flag anomalies, and even draft audit summaries, reducing compliance risk while saving time.

✅ Investor Communication

Firms are using AI to create investor-ready presentations, earnings call summaries, and fund fact sheets tailored to different stakeholders.

Why This Matters Now More Than Ever

According to a 2025 report by Deloitte, over 45% of financial services firms globally are experimenting with or actively using generative AI in reporting and analytics. India’s fintech and BFSI sectors are fast catching up, and professionals who understand how to leverage AI alongside financial data are in high demand.

Why Choose Certification Courses for Financial Analytics in Pune?

Pune has become a rising tech and finance hub in India, with a strong presence of multinational corporations, banking firms, and fintech startups. The city’s growing ecosystem makes it the perfect place to upskill in financial analytics with a focus on emerging technologies like generative AI.

Certification Courses for Financial Analytics in Pune offer:

Training in AI-powered tools like ChatGPT, Copilot, and AutoGPT for finance

Practical skills in Python, Excel automation, and Power BI

Real-world projects on report automation, risk analytics, and forecasting

Exposure to NLP (Natural Language Processing) for financial content generation

Placement support and networking in Pune’s financial and IT sectors

Skills You’ll Gain from These Courses

Skillset

Applications in Finance

Natural Language Generation (NLG)

Drafting earnings summaries, investment insights

Python for Finance

Automating data pipelines and generating model outputs

Power BI + AI

Visual dashboards with automated storytelling

Data Analysis with AI

Real-time scenario and variance analysis

AI Prompt Engineering

Extracting accurate, contextual financial narratives

Who Should Consider This?

Finance professionals looking to stay ahead of automation trends

Accountants and FP&A analysts wanting to automate reporting workflows

Business intelligence analysts working with large datasets

Fintech employees exploring GenAI-driven innovation

Fresh graduates aiming for future-proof finance careers

Top Career Opportunities in AI-Driven Finance

Role

What You’ll Do

AI-Powered Financial Analyst

Combine modeling with AI insights for smarter reports

Financial Automation Consultant

Streamline reporting processes using AI tools

Generative AI Finance Specialist

Create custom models for real-time business intelligence

BI Developer – Finance Domain

Build automated dashboards and AI-assisted workflows

Corporate Strategy Analyst

Use AI-driven analytics to guide executive decisions

Conclusion: The Future of Finance is Intelligent and Automated

Generative AI is not here to replace finance professionals—but to augment their capabilities, reduce routine tasks, and elevate decision-making. As finance evolves, those who embrace tools like AI, automation, and smart analytics will lead the industry forward.

Whether you're a finance graduate, analyst, or business leader, now is the time to invest in your future. Certification Courses for Financial Analytics in Pune offer the right combination of technical skills, industry exposure, and AI integration to help you thrive in this new era of intelligent finance.

0 notes

Text

Log Management Market Report: Unlocking Growth Potential and Addressing Challenges

United States of America – June 23, 2025 – The Insight Partners is excited to launch its latest report titled "Log Management Market: Driving Security and Operational Intelligence." The report captures the escalating importance of log data in modern IT environments and security frameworks.

Overview of Log Management Market

Organizations across industries are generating massive volumes of logs daily. Managing and analyzing these logs is no longer optional — it’s critical for cybersecurity, system optimization, and compliance. Log management has evolved from traditional storage to intelligent, AI-enhanced platforms.

Key Findings and Insights

Market Size and Growth

The global log management market is expected to grow at a CAGR of 12.8% during 2023–2031, propelled by digital transformation and increasing security threats.

Key Factors Driving the Market

Surging need for real-time threat detection and response

Increased complexity of IT systems and hybrid infrastructure

Growing regulatory requirements for data access and transparency

Market Segmentation

By Component:

Software

Services

By Deployment:

On-premise

Cloud

By End-User:

BFSI

Healthcare

IT & Telecom

Retail

Government

Spotting Emerging Trends

Technological Advancements

AI-driven anomaly detection

Integration with Security Information and Event Management (SIEM) tools

Changing Consumer Preferences

Preference for unified observability platforms

Demand for scalable solutions across cloud-native applications

Regulatory Changes

Expansion of compliance mandates (e.g., SOC 2, GDPR, HIPAA)

Industry-specific log retention policies

Growth Opportunities

Expansion into SMB segments with cost-effective solutions

Rise of managed security services requiring log integration

Automation and AIOps adoption to reduce manual monitoring

Conclusion

The Log Management Market is positioned at the intersection of cybersecurity and IT efficiency. This report is a must-read for enterprises, IT leaders, and cybersecurity firms looking to future-proof their data and digital infrastructure through smart log analytics and compliance-driven innovation.

About The Insight Partners The Insight Partners is a leading provider of syndicated research, customized research, and consulting services. Our reports combine quantitative forecasting and trend analysis to offer forward-looking insights for decision-makers. With a client-first approach, we deliver actionable intelligence and strategic guidance across various industries.

Visit our website- https://www.theinsightpartners.com/ to learn more and access our comprehensive market reports.

Get Sample Report- https://www.theinsightpartners.com/sample/TIPRE00006168

0 notes

Text

Field Efficiency with Field Force Management Software by FieldEZ Technologies

In today’s dynamic business landscape, managing a mobile workforce efficiently is crucial for success. Organizations dealing with on-ground service teams face constant challenges in task allocation, real-time communication, performance tracking, and ensuring timely service delivery. This is where field force management software becomes a game changer. FieldEZ Technologies stands out in this space with innovative software solutions tailored to transform field operations across industries.

What is Field Force Management Software?

Field force management software is a digital solution designed to automate, streamline, and optimize the operations of field teams. It enables businesses to track field personnel, assign tasks dynamically, monitor performance metrics, and ensure timely service execution. Whether you’re managing a team of service engineers, sales executives, or retail promoters, an effective software suite ensures improved productivity and customer satisfaction.

FieldEZ Technologies — A Pioneer in Service Management Software:

FieldEZ Technologies is a leading provider of field service management software and mobility solutions. Trusted by thousands of users globally, FieldEZ offers a range of products that cater to diverse operational needs:

ServiceEZ: Tailored for managing after-sales service and maintenance teams, ServiceEZ helps schedule jobs, manage service tickets, capture feedback, and ensure SLA compliance.

SalesEZ: Designed for sales professionals, this product empowers managers to monitor field visits, lead progress, and enhance client engagement through real-time data and analytics.

RetailEZ: Ideal for managing retail execution, RetailEZ enables effective tracking of field promoters, stock visibility, planogram compliance, and more.

Key Features of FieldEZ’s Field Force Management Software:

Automated Task Scheduling — FieldEZ’s software enables automatic task allocation based on availability, proximity, and skill set, reducing response times and boosting field efficiency.

Real-Time Tracking & Communication — Field agents can be tracked in real-time, enabling managers to make quick decisions and support field teams proactively. Integrated messaging tools also improve internal communication.

Custom Reporting & Analytics — Detailed dashboards and custom reports provide actionable insights into agent performance, customer feedback, and operational bottlenecks.

Mobile-First Interface — Designed with a mobile-first approach, the software ensures that field agents can work seamlessly from their smartphones, even in offline mode.

Customer Engagement Tools — Enhance the customer experience with timely updates, electronic signatures, instant feedback capture, and more.

Why Choose FieldEZ?

FieldEZ’s service management software stands out due to its flexibility, ease of integration, and industry-specific customization. Whether your business is in telecom, healthcare, BFSI, manufacturing, or consumer goods, FieldEZ’s modular approach ensures that you get a solution that perfectly fits your operations.

The software doesn’t just manage field tasks — it empowers your business to grow. By reducing turnaround times, lowering operational costs, and increasing transparency, FieldEZ helps you deliver superior customer service.

Final Thoughts:

In an era where field operations are central to customer satisfaction and business success, adopting a robust field service management software like that offered by FieldEZ Technologies is no longer optional — it’s essential. With products like ServiceEZ, SalesEZ, and RetailEZ, FieldEZ enables businesses to gain a competitive edge through technology-driven field efficiency.

If you’re looking to elevate your service standards, improve team coordination, and streamline workflows, FieldEZ’s field force management software offers the perfect solution.

#fieldez#field service#services#apps#management software#field management#field service software#field force management#field workforce management#workflow automation

0 notes